Enrich entire benefits offerings with a modern plan powered by OneBridge. The YourWay ICHRA is the premier, turn-key Individual Coverage HRA with seamless enrollment, cost control, and tailor-fit coverage.

Lessen your organization’s responsibilities, and gain you more control.

The YourWay ICHRA provides employers with a simplified health benefit option that enables them to focus resources on what they do best—not administering benefits. Here’s how it works:

Step 1:

Employers provide tax-free funds to employees (who need health insurance) into an ICHRA account.

Step 2:

OneBridge helps those employees select tailor-fit coverage from their community marketplace.

Step 3:

Employees use the funds in their ICHRA accounts to pay for their insurance premiums.

Step 4:

Any unused funds can be used (in perpetuity) by the employees for any qualified medical expenses.

Addressing the shortfalls of traditional group health benefits.

If you’re an experienced-rated organization, your health benefits (along with your time and resources) are not being maximized. Here’s how our ICHRA solution addresses the problems with traditional group health insurance.

Problem 1: Employers designing a plan for their employees.

YourWay ICHRA Solution: Employers just provide a contribution and let employees pick for themselves.

Problem 2: Employers being limited in the number of plans that they can offer a diverse workforce.

YourWay ICHRA Solution: There are over 60 plans available on most community markets.

Problem 3: There is a higher inherent business risk tied with employer-owned plans.

YourWay ICHRA Solution: Individual market plans are community-rated and more regulated, which helps reduce the risk of significant (and unexpected) increases.

Problem 4: It’s difficult to provide health plans to a multi-state workforce.

YourWay ICHRA Solution: Each employee purchases insurance from their local carriers, removing the need for costly PPO plans.

Problem 5: Employees lose insurance upon separation, and employers are responsible for administering COBRA.

YourWay ICHRA Solution: Employees own their coverage, making plans portable, removing employee’s need for COBRA.

Problem 6: Lack of appreciation and understanding of employer benefit offerings.

YourWay ICHRA Solution: Benefits contributions and premium costs become transparent to employees which results in greater appreciation of the benefits package.

Onboarding made easy.

Supported by The OneBridge Agency, our white-glove enrollment team oversees every phase of the process—from your introductory meeting and custom plan design to seamless onboarding and ongoing customer support. What does this include?

- One-on-one meeting availability for all employees—virtual and in-person.

- Supported by an onboarding team with decades of experience.

- Tailor-fit coverage selection support.

- Intuitive browser-based benefit administration solution and marketplace experience.

- Post-enrollment support (via our friendly call center) when questions and needs arise.

Our enrollment team averages a 9 out of 10 in post-enrollment satisfaction reviews, and strives to make sure every onboarding is seamless.

But wait… There’s more!

Additional benefits of an ICHRA include giving your employees over the age of 65 the ability to use your tax-free HRA contribution to purchase the subsidized Medicare coverage that they have worked their whole life to benefit from. This typically results in significant extra funds for these employees to pay for health-related expenses not covered by Medicare or to save for health expenses when they eventually retire.

Average comparable group plan cost savings:

13%

Employees saving money for future health expenses:

36%

Average number of plans selected per 100 people:

30+

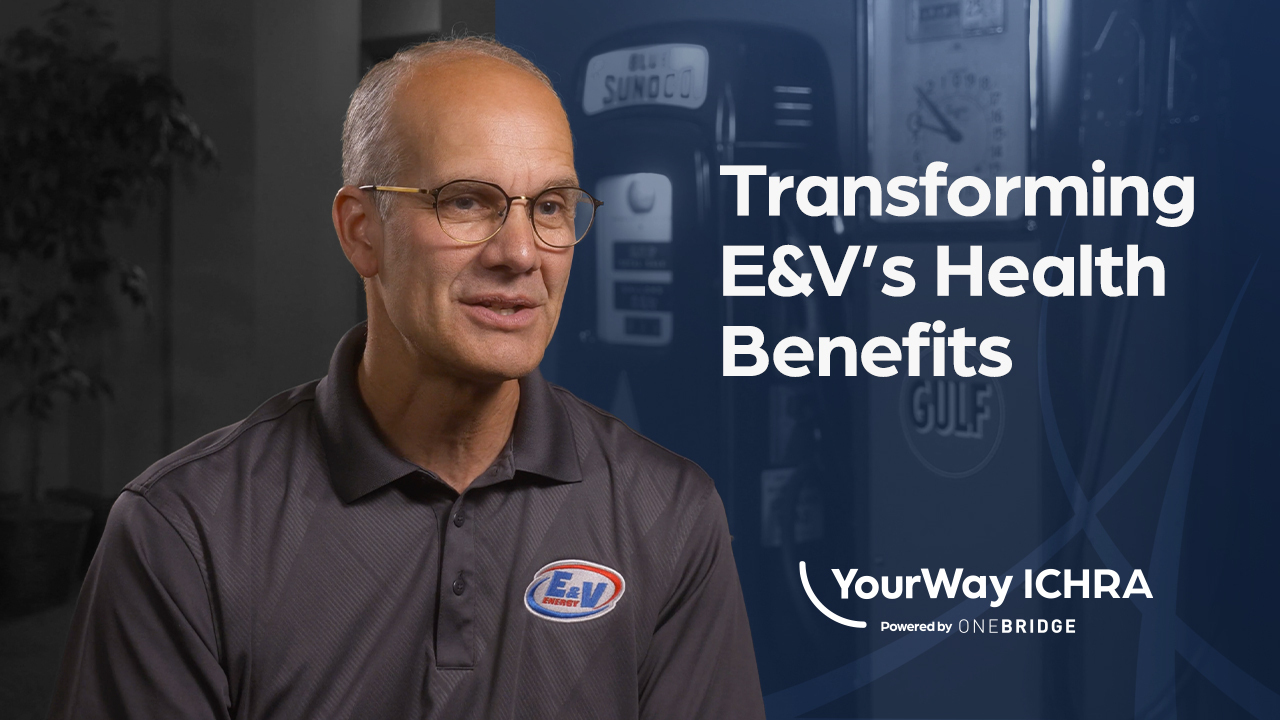

See how those numbers have impacted the organizations we serve.

The YourWay ICHRA is built for your business.

Backed by our first-of-its-kind administration platform, as well as HRA and FSA plan design expertise, OneBridge Benefits powers the YourWay ICHRA, handling everything from initial cost analysis and compliance to ongoing management and regulatory reporting.

Benefit Portability

Any unused YourWay ICHRA funds are portable and can be used for future health expenses—providing a lifelong healthcare benefit.

Section 125 & POP Integration

Employers determine contribution amounts. OneBridge handles the rest, including Premium Only Plan contributions to provide income and payroll tax savings.

Online Portal & Mobile App

The YourWay ICHRA comes with the industry’s first and only technology solution that supports recordkeeping and reconciliation for employers, and allows employees to receive real-time claims statuses, view balances, and more!

Integrated Debit Card

YourWay ICHRA participants receive a debit card to conveniently pay for premiums and other qualifying medical expenses.

Stackable FSA

OneBridge allows businesses to bundle more benefits by stacking a Flexible Spending Account (FSA) on top of the YourWay ICHRA plan, thereby increasing tax savings.

Personalized Support

In addition to single login access to our proprietary technology platform, receive personalized service from our experienced OneBridge customer care team members.

Is the YourWay ICHRA right for your organization?

What is an ICHRA?

ICHRA is short for an Individual Coverage Health Reimbursement Arrangement. This health benefit vehicle allows employers to free themselves of experience-rated group health plans and gain more control over their health benefit spend. Through an administrator like OneBridge Benefits, employers use the YourWay ICHRA to contribute pre-tax funds into employees’ YourWay ICHRA accounts, which employees then use to purchase healthcare coverage on the individual market. But the benefits don’t stop there.

What differentiates the YourWay ICHRA?

Every day makes it more apparent—savings is the new compensation. Instead of promising access to an insurance plan that not all employees value in the same way, the YourWay ICHRA allows employers to contribute actual pre-tax funds that can grow and be used in perpetuity until exhausted, serving as an additional retirement benefit for employees.

What types of businesses does the YourWay ICHRA work best with?

YourWay ICHRA is designed to help any business—big or small—gain greater control over the rising costs of healthcare. More specifically, the YourWay ICHRA is a great fit for healthcare, transportation, and technology companies with 50+ employees.

How will the YourWay ICHRA save me time on COBRA administration?

With employees owning their own health insurance plans, there is no coverage loss in the event an employee leaves. OneBridge handles all required COBRA notifications and processes for you, but your employees won’t need to elect COBRA to maintain their coverage.

Will my employees like this?

No, your employees are going to love this. Our average post-enrollment satisfaction score is 9/10. Frequent comments include, “This is so easy,” “I love it,” and “I finally have control over my insurance!”

The YourWay ICHRA proves the legacy model is becoming unsustainable.

If you’re an employer looking for a way out of annual plan price hikes, the restraints of experience ratings, and a competitive edge when it comes to teambuilding, you’re in the right place. Start offering health benefits the best way possible—YourWay.