If you haven’t already, we encourage you to use the OneBridge Benefits Savings Calculator to help plan your future FSA election amounts so that you can maximize your tax-savings potential.

One of the primary benefits of a OneBridge administered FSA is the ability to set aside tax-advantaged dollars (money taken out of your paycheck before taxes are) for qualified healthcare- and dependent care-related expenses. Now, you may be wondering why the pre-tax deduction is so advantageous. And it may not seem as beneficial reading the words or hearing it presented to you in a typical HR meeting. But when you get into the numbers and breakdown what you typically spend on health-related expenses in an average year, you can actually see just how much money you’re able to save by enrolling in an FSA.

Having recently launched our new OneBridge Benefits website—which better represents our complete suite of health benefits account administrative services, software, customer support, and HRA and FSA benefits—we added a new tool that allows you to see your average annual savings with having an FSA in an instant. And it does more than provide anecdotal examples. Our new Savings Calculator allows you to see just how much of your paycheck you can keep while still setting pre-tax dollars aside to pay for eligible health or dependent care related expenses through an FSA administered by OneBridge Benefits.

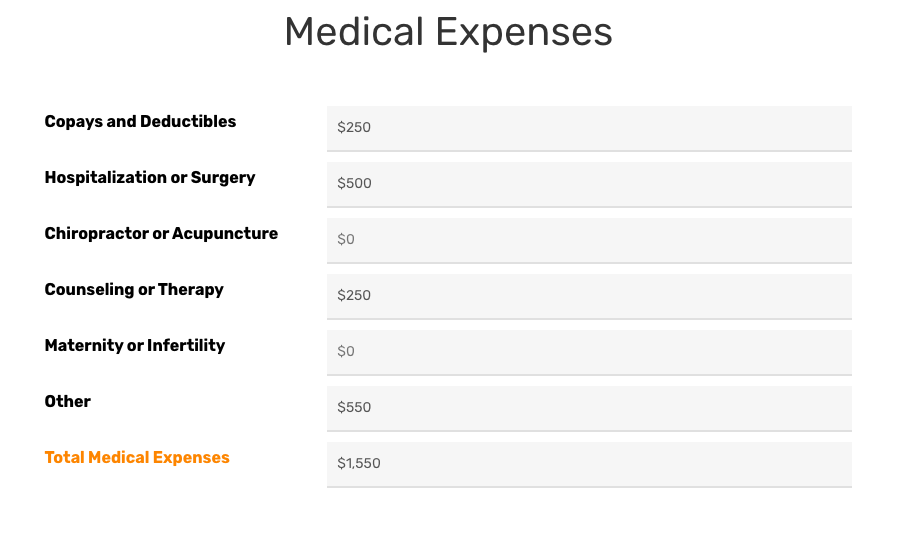

Medical Expenses

The broadest category of qualified expenses you can use FSA funds for is Medical Expenses. These include office copays, lab tests, imaging scans, hospital bills, counseling and therapy, and more.

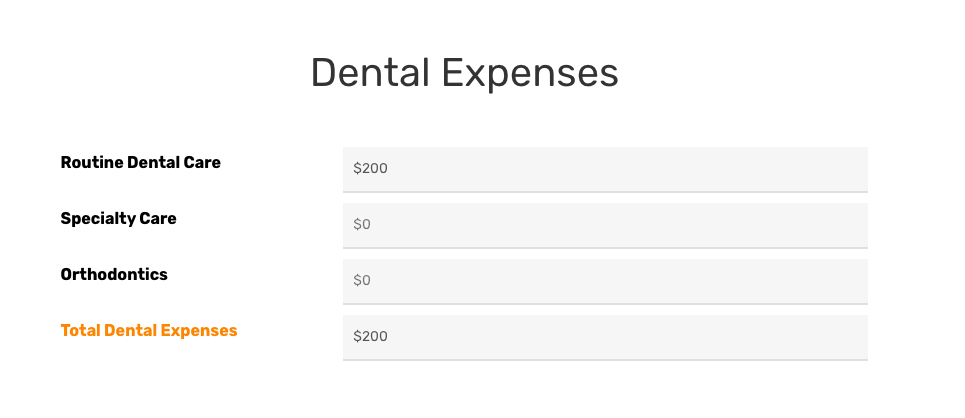

Dental Expenses

Dental expenses include yearly cleanings, orthodontics such as braces, retainers, and alike, specialty dental procedures such as root canals and cavity fills, and many more. Let’s add those typical yearly dental expenses for you and your dependents into the equation.

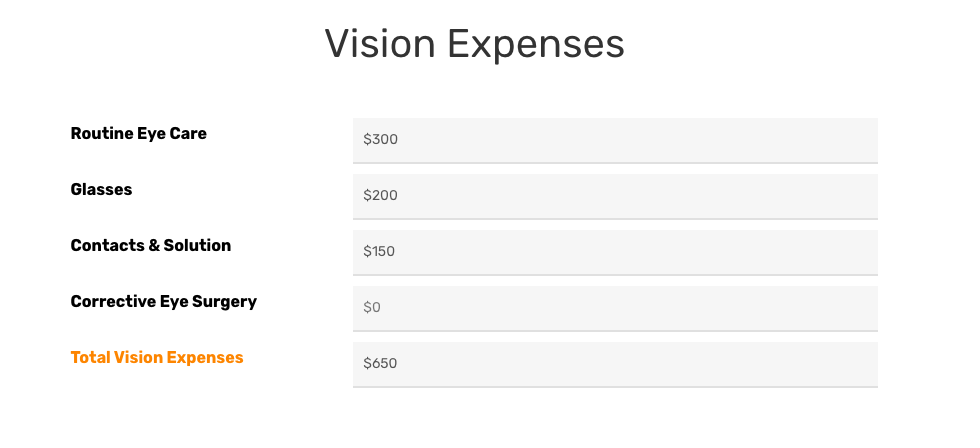

Vision Expenses

If you have had glasses, corrective eye surgery, contacts, and other vision-related expenses in the past, you know how quickly they can add up. Several of those vision expenses (and others) do qualify for FSA funding.

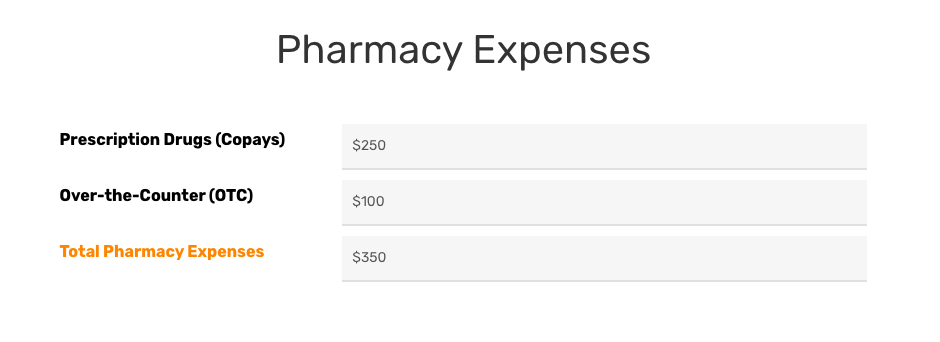

Pharmacy Expenses

Chances are you have regular prescription medications you and your family require every month, including medication for allergies, high blood pressure, and others. If and when you get sick, and your doctor prescribes you an antibiotic, your pharmacy’s co-pay can be paid for using the pre-tax funds already set aside in either FSA.

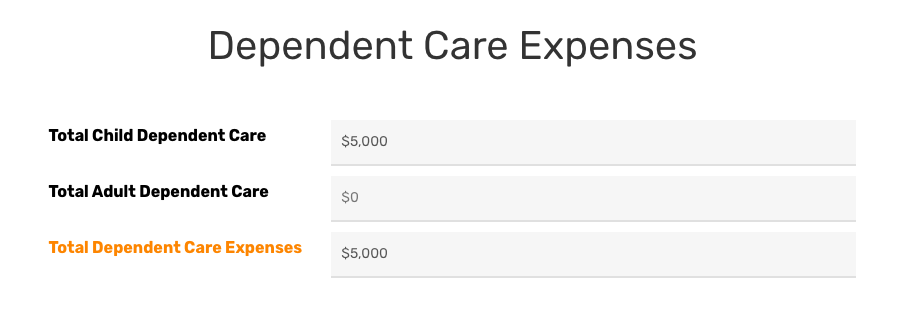

Dependent Care Expenses

Dependent care can be one of the more costly health-related expenses you’re responsible for as these expenses include childcare AND eldercare. The IRS currently allows you to elect a maximum of $5,000 for your Dependent care FSA.

Enrolling in your employer-sponsored OneBridge administered Dependent Care FSA could prove to be extremely cost-effective and beneficial for you and your family.

Let’s use this IRS allowed maximum in our Savings Calculator example.

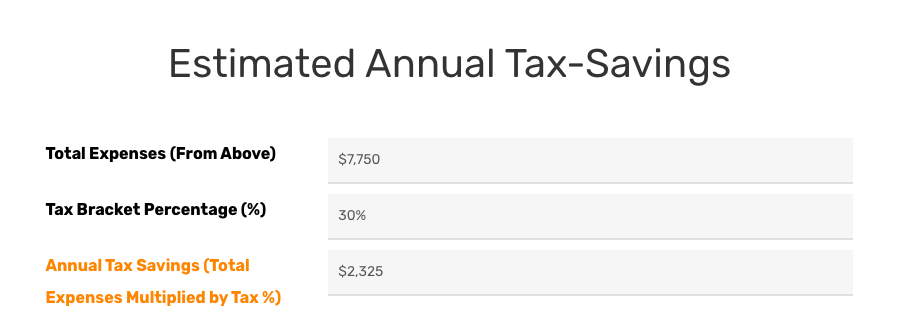

Total Pre-Tax Savings

As you can see, the benefits of having a OneBridge administered FSA do in fact stack up over the course of an average plan year. In this case, the pre-tax savings—using an average tax bracket of 30%—equate to over $2,300 in annual savings!

Keep in mind that the OneBridge Benefits Savings Calculator automatically computes these totals and savings for you as you enter them into each field, providing you with a real-time look at just how much you could save on these typical healthcare- and dependent care-related expenses with an FSA.

Interested in using the OneBridge Benefits Savings Calculator? Whether you’re currently enrolled in an HRA, and looking to stack benefits with an FSA, or are looking to enroll in an FSA for the first time, this online tool helps you see real savings available to you.

If you have additional questions about the savings benefits of a OneBridge FSA, please give one of our customer care associates a call at 888.335.4415.

Note: For 2020 plan years, the IRS limits the maximum Healthcare annual contribution to $2,750, and the maximum Dependent care annual contribution to $5,000.00. Your employer may have set different limits on your maximum annual contribution, please be sure to check with your employer’s benefit representative before making a final decision.